Digital banking belongs to the wider context for the transfer to on-line financial, where financial solutions are delivered over the web. The change from conventional to digital financial has been gradual and also remains recurring, and is constituted by differing levels of financial solution digitization. Digital banking involves high degrees of procedure automation and online services and also may consist of APIs enabling cross-institutional service composition to supply banking products and provide deals.

A digital bank represents a virtual process that consists of on-line banking as well as past. As an end-to-end system, electronic banking must incorporate the front end that customers see, the backside that bankers see through their servers as well as admin control panels as well as the middleware that connects these nodes. Inevitably, a digital bank ought to promote all functional levels of financial on all solution delivery platforms.

The factor digital financial is greater than simply a mobile or on the internet system is that it includes middleware solutions. Middleware is software program that bridges operating systems or databases with various other applications. Monetary market divisions such as danger monitoring, product development and also advertising must likewise be included between as well as backside to truly be thought about a full electronic financial institution.

Nib International Financial institution is dedicated to procedure under the transforming infotech. Hereof, various software application remedies were Inside established. Among which; software that makes sure a safe intra office interaction platform is applied. Supply Management System and Signature Capture and also Retrieval System are under application. Furthermore, a Queue Management improvement for the forex application.

As the internet emerged in the 1980s with very early broadband, digital networks began to link retailers with providers and customers to establish needs for early online catalogues as well as supply software application systems. By the 1990s the Net ended up being widely readily available as well as on the internet banking began coming to be the standard. The renovation of broadband and ecommerce systems in the early 2000s caused what appeared like the contemporary digital financial world today.

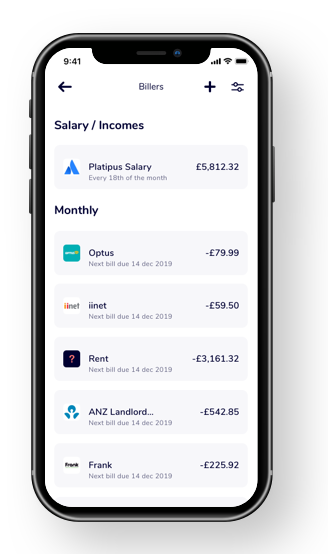

Over 60% of consumers now use their smartphones as the recommended method for electronic financial. The difficulty for financial institutions is now to assist in demands that attach suppliers with cash with channels figured out by the consumer. This dynamic forms the basis of consumer complete satisfaction, which can be supported with Client Partnership Management (CRM) software application.

There is a demand for end-to-end uniformity and for solutions, enhanced on benefit as well as user experience. The marketplace provides cross system front finishes, allowing acquisition choices based upon available innovation such as mobile phones, with a desktop computer or Smart TV in your home. In order for financial institutions to meet customer demands, they require to maintain focusing on enhancing digital technology that provides dexterity, scalability and also performance.

Only 16% highlighted the capacity for price conserving. Major benefits of electronic financial are: Company effectiveness - Not only do electronic platforms boost communication with consumers as well as supply their demands quicker, they likewise provide approaches for making internal functions more reliable. While banks have actually been at the leading edge of digital modern technology at the consumer end for years, they have not completely accepted all the benefits of middleware to speed up performance.

Traditional bank processing is expensive, slow-moving as well as prone to human error, according to McKinsey & Firm. Relying upon people as well as paper likewise occupies office, which adds energy and storage space prices. Digital systems can future decrease costs through the harmonies of more qualitative data and faster reaction to market adjustments.

Coupled with absence of IT combination in between branch as well as back office personnel, this trouble minimizes organization effectiveness. By simplifying the verification process, it's simpler to implement IT solutions with business software program, causing more exact bookkeeping. Financial accuracy is important for financial institutions to adhere to government regulations. Enhanced competition - Digital services assist handle advertising and marketing listings, permitting financial institutions to get to more comprehensive markets as well as develop closer relationships with tech smart consumers.

It works for carrying out consumer incentives programs that can enhance commitment and also complete satisfaction. Greater agility - The use of automation can accelerate both outside as well as interior procedures, both of which can improve client contentment. Adhering to the collapse of economic markets in 2008, a boosted focus was positioned on risk monitoring.

Improved safety and security - All businesses large or small face an expanding variety of cyber dangers that can harm reputations. In February 2016 the Irs revealed it had been hacked the previous year, as did several big technology companies. Financial institutions can gain from added layers of protection to secure information.

By replacing manual back-office procedures with automated software program options, banks can decrease staff member errors and speed up processes. This paradigm change can cause smaller sized functional systems as well as allow managers to focus on improving jobs that need human treatment. Automation reduces the adi banks demand for paper, which unavoidably ends up taking up area that can be inhabited with modern technology.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA