Tips To Improve Digital Banking Experiences Things To Know Before You Buy

Table of ContentsWays To Improve The Digital Banking Experience Fundamentals ExplainedTop Ways For Banks To Improve Customer's Digital Banking Things To Know Before You Get ThisNot known Facts About Simple Steps For Increasing Digital Banking Adoption

It's a truth, that as a monetary organization, you have a fantastic responsibility for your consumers' satisfaction. You should do your best work http://edition.cnn.com/search/?text=digital banking experience to shut all those spaces which exist in your solution. It is the 21st century, and also your growth primarily depends upon the digital financial experience of your customer.

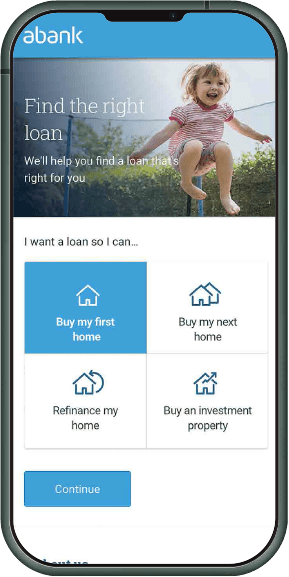

Customers see countless messages a day which implies your messages risk getting lost because sea of thousands (in addition to all the ads from other banks and lending institution). So, if you desire your electronic capabilities to stand apart, concentrate on the benefits. What do users actually want? What benefit can they not live without? How do you offer that to them? And also, to help your own stand apart, distinguish your digital option with these four strategies.

Which of the below is more engaging? "50 Jobs of Storage Space" or "Conserve approximately 10,000 of your valued images." When it comes to your electronic financial abilities, absolutely no in on the most useful, compelling benefitsand concentrate on that as your beginning point. Take advantage of the emotions of the reader.

As customers begin to utilize even more electronic banking solutions, their expectations have actually boosted and changed. In years past, clients were satisfied with fundamental online account monitoring that allowed them view details for existing accounts. Currently, consumers wish to have the ability to send out cash to a variety of accounts, accessibility credit rating card incentives, and also personalize their account settings from anywhere.

Simple Steps For Increasing Digital Banking Adoption Can Be Fun For Anyone

As obtains smarter and much faster, financial institutions are brainstorming even more methods to market their services and assist their customers make much better financial selections. Financial institutions can enhance brand-new sign-ups and by spending in engaging, appropriate attributes that benefit from the riches of information offered on consumers. Consumers have a wide variety of demands relying on the services they're accessing, their way of livings, as well as the modern technology offered to them.

The added benefit of digital banking makes it less complicated for customers to pay their costs on-time whenever they keep in mind, rather of taking care of paper forms or telephone call. This can reduce late payments as well as costs, boosting consumer complete satisfaction and also trust., and banks can enhance as well as advertise their safety efforts to draw in as well as retain clients.

By utilizing machine learning to instruct AI programs about customer fads scraped from big data, banks can identify and flag purchases that are uncommon and also most likely to be illegal. Customers do not like handling duds, so banks have to get the to keep false positives to a minimum. When consumers feel their account info is firmly protected, they are much less most likely to shut charge card or take other actions to decrease their dependence on a bank.

In today's increasingly digital world, consumers have extra choices than ever before even more. Economic establishments must seek new methods to involve consumers with electronic networks, while guaranteeing an individual and relatable consumer experience. Studies reveal that financial organizations that prioritize "humanizing" the electronic financial experience are much better able to develop trust fund with consumers and also separate their organizations in a commoditized industry.

Some Known Details About Top Ways For Banks To Improve Customer's Digital Banking

regarding digital interruption in economic services, huge banks are really holding their own. Around the world, financial-services revenues have grown 4 percent each year over the previous 10 years (thanks mostly to growth in emerging markets), and fintech start-ups and huge tech companies have thus far caught just tiny slivers of market share.

Capitalists think fintech startups will certainly become a considerable force in the future, valuing those in the US at $120 billion, or 7 percent of the overall equity people financial institutions. As we see it, several banks haven't establish their views nearly high sufficient in reaction to disruptive aggressors. They've been excessively cautious, playing defense, with me-too electronic initiatives mainly made to counter relocations by real or potential disruptors.

Large bankslike several incumbentshave been flooded with new technologies and also service possibilities, leaving them baffled concerning where to focus and also dissipating their resources. A lot of big banks have the devices as well as benefits to press the borders of their existing company versions. As well as they're absolutely encouraged. What obstructs their progress is uncertainty concerning exactly how finest to improve core staminas to create sustainable results.

Financial institutions have actually lengthy relied upon making customers aware of relevant items as a course to development. In the past, that come close to was about https://www.sandstone.com.au/en-au/bxp introducing other financial products. For instance, a client with a checking account would certainly be urged to consider an individual line of debt, a home-improvement lending, or a financial institution credit scores card (see inner circle of exhibition, labeled Core).

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA